Lexul Field Service now has the option to easily track both 1099 contractors and employee work time without hassle! Lexul Field Service integrates our time logging with QuickBooks, so employee labor costs can be included in job cost reporting.

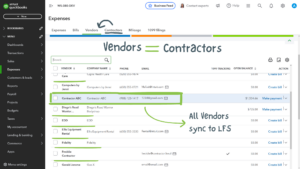

Vendors as 1099 Contractors in QBO

Even though QuickBooks Online has specifically, ‘Contractors’, ‘Vendors’ are the exact same thing, but with more details. If a new contractor is added to ‘Contractors’ in QBO, it becomes a Vendor –but with less information attached. Then, one must go to the added contractor under Vendors, and add the essential info there. To make it easy for you, it’s only neccesary to add Vendors (as contractors) to QBO for Lexul Field Service. We sync Vendors with the proper display name, and address –as these show on the synced bill from LFS –> QBO.

Employees Auto-Sync, Contractors Invited

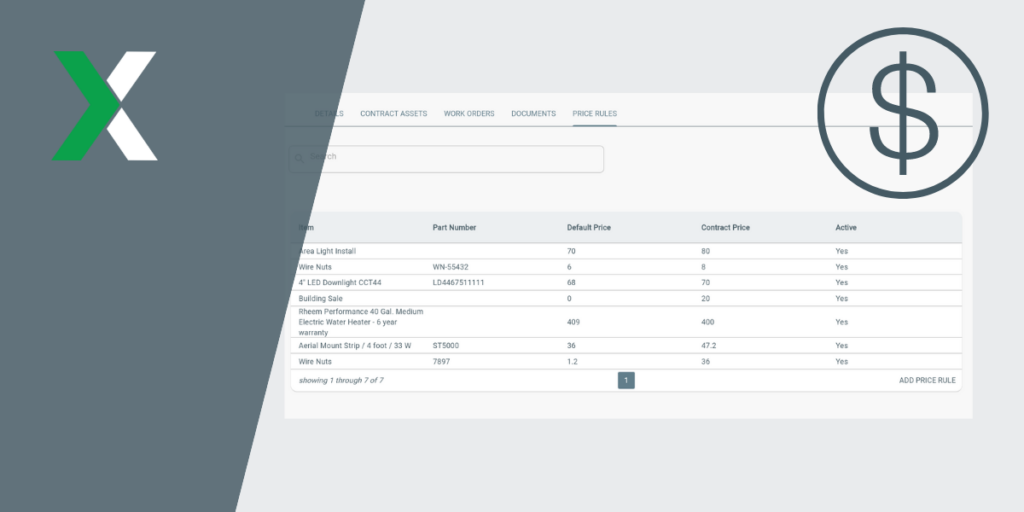

By default, if integrated to QuickBooks Online from Lexul Field Service –along with customers, sub-customers, products, services, –employees will sync to LFS as users. However, 1099 contractor users will have to be invited from the LFS side. But, no sweat, as this is quite easy. Once invited and added, the contractor user can quickly be linked to a synced vendor (contractor), and an hourly rate can be applied; –this is the rate used when paying/billing vendors.

Tracking & Syncing 1099 Contractor Work Time

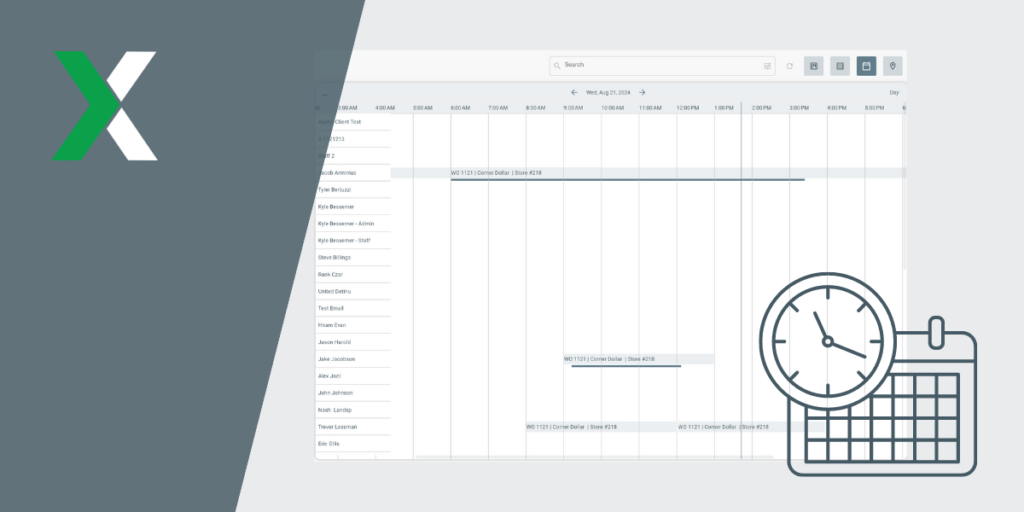

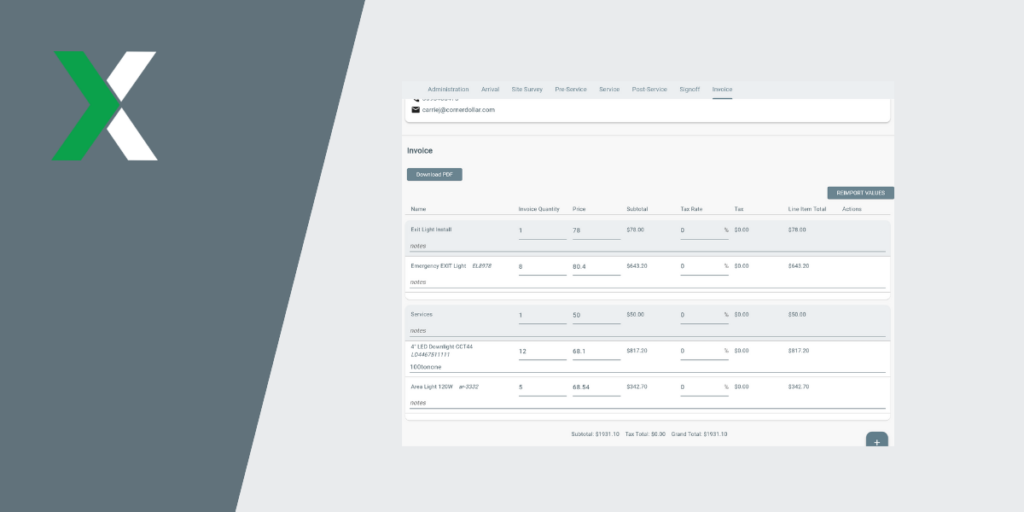

So how does one begin to track contractor time? Contractors have the option to be assigned to work orders. This grants them the ability to track work time. When assigned, the work shows up on their personal dashboard, and they can begin to work right away! After the service and work order is completed by them, the office can look over all the tracked time, approve it, and begin to ‘Pay Vendors’. With a few clicks, Vendor bills can be sent to QuickBooks: —In the sidebar menu, find ‘Timesheets’ > find the top right tab called ‘Pay Vendors’ > Select a cut-off date and a Vendor to send the bill to (cut-off date can be used for maintaining a pay period schedule) > Hit submit. That’s it! The bill will show in QuickBooks Online immedietely. Each line item total on the synced bill is calculated by hourly contractor rate * hours. So if there is multiple line items, that means there was multiple work time periods from the contractor.

Approved Employee Time Auto-Syncs

Unlike contractor time, employee time auto-syncs after time is approved from the office side. There isn’t a need to send a seperate bill. All employee work times will show in the weekly timesheet in QuickBooks Online after approval.

As we continue to expand our capabilites, we strive to improve your overall experience with QuickBooks as well as your workflow process! If you have any questions, please reach out to us: support@lexul.com –we would also love to hear from you by sending feedback to us! We are always here and happy to help!

Looking forward to talking with you!

Austin, LFS Team